|

Schiller Institute in Denmark testifies in Danish Parliament about the need for LaRouche’s New Bretton Woods financial system On Wednesday Oct 2, 2008, the Schiller Institute testified in the Political-Economic Committee, before 7 parliamentarians, from 4 non-government coalition parties. Tom Gillesberg held the speech below, and afterwards, appealed to the parliamentarians that the current financial crisis is not like the 30’s, but, rather, the collapse of Europe which occurred after the 14th century collapse of the Bardi and Peruzzi. This led to the disintegration of the financial system and the society, and a new dark age, where Europe’s population was reduced to one third. This is not just some people losing money. The Parliament has to deal with this. On Saturday, Sarkozy has called a crisis meeting. Denmark is not in the G-8, but we should join the meeting. The chairman, from the far left party, said that we agree that there is a big crisis, but just disagree about what to do about it. As there were no questions to Gillesberg, the chairman said that it is not because of the lack of interest, but because we know your opinions very well, through your previous testimony [in January] and your written material. Thank you for putting focus on this problem. Directly after the SI testimony, the Economy and Business minister Lene Espersen testified in open committee, with the Danish press in attendance, about the actions she will take to protect Denmark and the population in front of the international and Danish financial and bank crisis. Afterwards, SI organizer got in the last question, as the minister was walking away from speaking to the press (se at the bottom of the page). Gillesberg’s written testimony was also distributed to the entire press corps present for Espersen’s testimony, as well as the Espersen and the staff members from her ministry who accompanied her, who Tom Gillesberg spoke shortly to. |

|

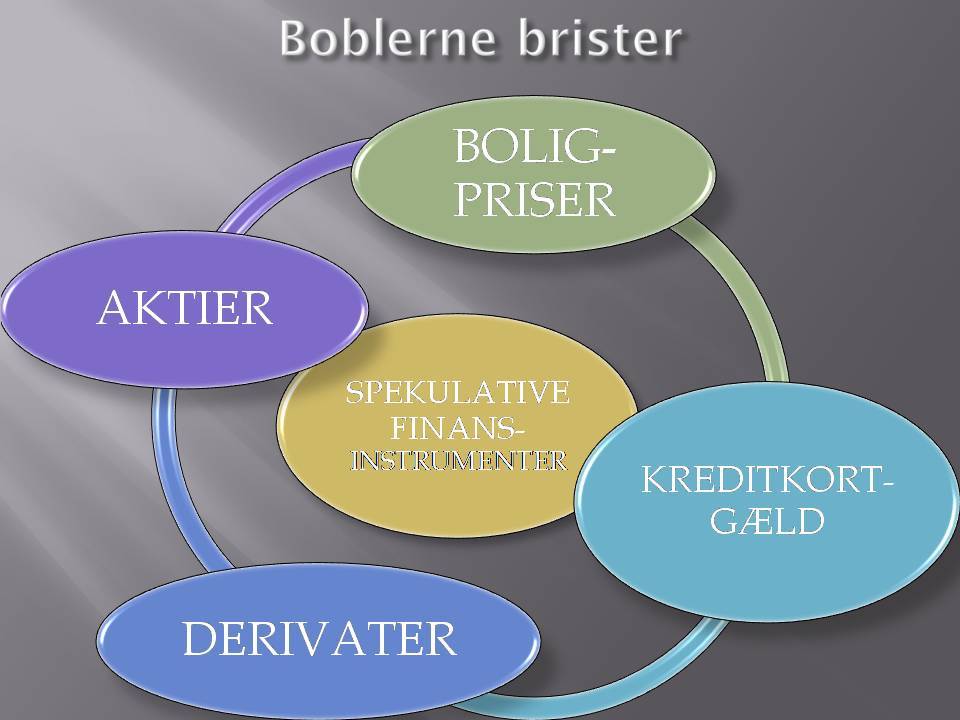

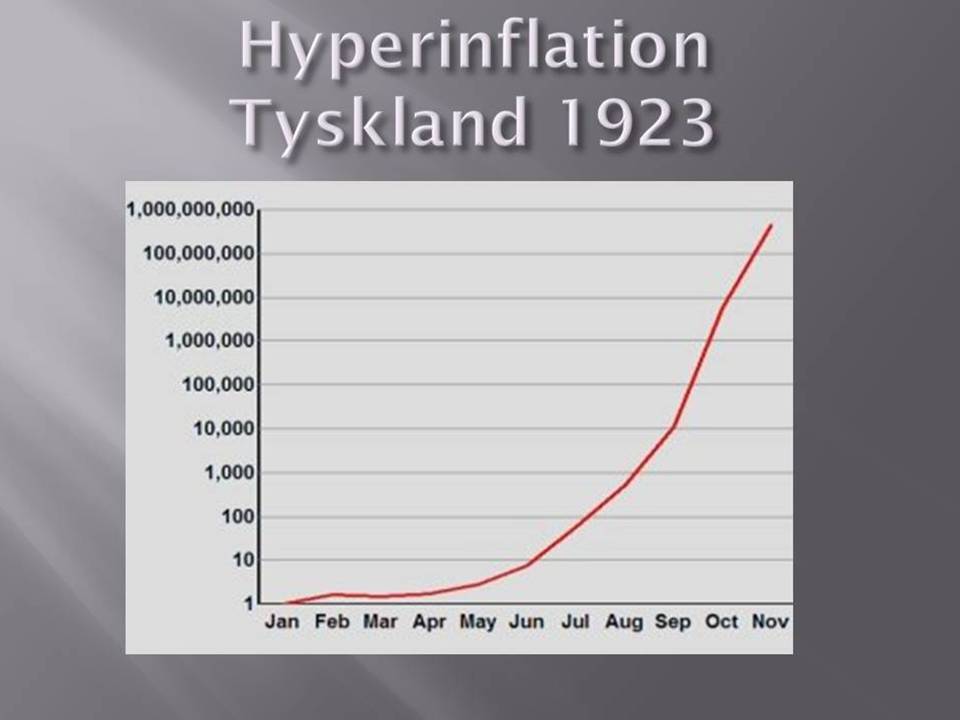

Testimony by Tom Gillesberg, chairman of the Schiller Institute in Denmark, before the Danish parliament's Political-Economic Committee on Oct. 2, 2008: Only a New Bretton Woods financial system can solve the financial crisis We are standing in the middle of the biggest financial collapse the world has ever seen. Gigantic paper values have already gone up in smoke, and many more will follow. Panic has already appeared, and the world's financial markets are screaming, "Save us, save us, give us more money." But close your ears to the song of the sirens, and the demand that taxpayers should save the speculators. There is no way that the current financial collapse can be stopped within the framework of the current system. Only through putting the whole system through bankruptcy reorganization, and establishing a new Bretton Woods financial system, based on the principles of Franklin D. Roosevelt, as proposed and elaborated by the American economist and statesman Lyndon LaRouche, is there a safe way out of the current crisis. Right now, the American government is trying to get a 700 million dollar bail-out package to the financial markets passed in the American Congress. It was good news that the Congress voted no in the first round, because if they succeed in getting it passed, it will not, as promised, save the financial system and our economic future. Maybe it will enable the speculators to be able to continue their casino gambling for a few more days, but if the state takes over the unpayable debt, they will create hyperinflation as in Weimar Germany in 1923, but, this time, on a global scale. It will transform the dollar to confetti. It is not only immoral for the taxpayers to take over the speculators' bad gambling debts, but it will also bring the nation's future security and the welfare of the citizens in danger.

LaRouche warned about the collapse There has been a widely circulated cliché in the media, and among politicians and economists, that no one could predict the current crisis, and that there is no alternative to pumping more money into the financial markets, but that is not true. For decades, Lyndon LaRouche and the Schiller Institute have warned against financial deregulation, and the shift from the physical economy to financial speculation, and the catastrophe that that inevitably would cause. For example, in the 2005 municipal elections, I tried to put the upcoming crisis on the political agenda, with the campaign, "When the bubble bursts... A New Bretton Woods." On July 25, last year, Lyndon LaRouche held a webcast from Washington, where he warned about a dramatic phase shift: We stood just in front of the disintegration of the entire international financial system. Three days later, the German IKB Bank collapsed under the weight of the bad "sub-prime loans." They were the snowball which started the avalanche. Afterwards, Lyndon LaRouche presented a three-point crisis plan for the U.S. We have not just warned about the depth of the crisis, but have also presented solutions, like when I ran for parliament, together with three other candidates, with the slogan, "After the financial crash: Maglev across the Kattegat." On January 17 this year, during testimony here before the Political-Economic Committee, I presented the immediate actions which ought to be set into motion in order to avoid the terrible consequences of an international financial collapse. Many of you may have felt that I exaggerated, or that the question was too big for parliament members to deal with, but there is no way around it. Parliament members have to have a clear picture of how a new financial system should be put together, and which actions we must take to protect our economy and population.

1. Save the banks and homeowners -- not the speculators As different banks and financial institutions fail, the authorities should not let the taxpayers take over the bank's debt (as was the case with Roskilde Bank). Instead, bankruptcy reorganization should ensure that the banks' normal banking operations continue unimpeded in a reconstructed bank, and the bad loans, derivatives, etc. (speculative financial instruments like options, futures, credit default swaps, mortgage-backed securities, etc.) should be frozen and taken care of later. Speculators can be allowed to loose their shirts, but it is important that small depositors and businesses are protected, and that the banks can continue their daily activities, which an economy can not be without. The state must at the same time prevent a flood of evictions.

2. A two-tiered credit policy Instead of uncritically pumping billions into the financial markets through national and central banks, we must direct national credit to those parts of the physical economy, which can suffer during the credit crisis, which is quickly becoming worse. We have to prepare ourselves for recognizing that the times in which the Danish deposit deficit could be gotten on the international financial markets, are forever over. Therefore, the state ought to use the national bank as a real Hamiltonian national bank, with a two-tiered credit policy. We can let the interest for loans to the financial markets be pretty high, and, simultaneously, have cheap credit at 1-2%, for investments in industry, farming and infrastructure, which the state issues, through the national bank, to private firms through their normal banks. In a similar way, we can finance connections across the Fehmarn Belt [across the Baltic Sea between Denmark and Germany], the Kattegat Sea [between Zealand, the island upon which Copenhagen is located, and the Danish mainland Jutland peninsula], and the Sound (Elsinore [Denmark]-Helsingborg [Sweden]), as well as public investment in highways, trains and maglev, hospitals, educational institutions and research. That can get the economy going when the loan-based consumption party ebbs out. If the crisis causes average families to not be able to get reasonable mortgages, etc., the state must also help out.

3. A New Bretton Woods The current financial system which has been destroyed by speculation has to be put through bankruptcy reorganization, and replaced by a modern version of the Bretton Woods system which Roosevelt initiated in 1944. The new system must be credit based, as Roosevelt had planned, rather than monetarist, so that there are built-in mechanisms to create credit for national and international projects. The growing revolt in the American population which resulted in the House of Representatives voting no to the Bush administration's bail-out package, gives hope that the U.S. can shift policy, and help launch a New Bretton Woods financial system, together with Russia, China and India, which have already signaled that they would join. It means that the current confrontation policy is replaced with a return to respect for national sovereignty and cooperation, in the spirit of the Peace of Westphalia from 1648. Other countries will, of course, also join. In Italy, Senator Oscar Peterlini, together with 19 other senators, have introduced a resolution in the Italian Senate, that the government should work for the introduction of a "new system formed like the New Bretton Woods, that the American economist Lyndon LaRouche has proposed", a thought which Italian Finance- and Economy Minister Tremonti has already promoted in a big way. French President Sarkozy has also just announced that he will convene a crisis meeting to prepare an international conference about a new financial system. Denmark ought to join and actively work for such a new financial system, which would establish fixed currently rates and raw material prices between nations, and create long-term credit for investment in production and infrastructure. As the same time, we must cooperate on big projects and development programs (like the Eurasian Land-Bridge), which will take up to two generations to complete, and which can increase the scientific and productive level. The ideology of globalization and ultra-liberal free market policy, without public oversight and control, has failed. Either we follow LaRouche's instructions and return to a policy which puts the general welfare of the population first, and can ensure economic growth in the real economy, or we will face a new dark age, with economic collapse, chaos and war. Therefore, Parliament should hold an emergency hearing about the financial crisis and the establishment of a New Bretton Woods financial system, and invite Lyndon LaRouche, who has been able to predict the crisis, and knows what to do, as an expert. Thank you.

Additional material which was given to members in connection with the testimony: 1. Statement by Tom Gillesberg after Lehman Bros collapse 2. statement by Tom Gillesberg that the Danish PM should join the Sarkozy meeting 4. "LaRouche: There is a Plan B" and "To Save Wachovia, Restore Glass-Steagall"

Response of

Lene Espersen to question Directly after the SI testimony, the Economy and Business minister Lene Espersen testified in open committee, with the Danish press in attendance, about the actions she will take to protect Denmark and the population in front of the international and Danish financial and bank crisis. Afterwards, SI organizer got in the last question, as the minister was walking away from speaking to the press. SI: Regarding international actions, what do you say about Sarkozy and Lyndon LaRouche’s proposal that we hold an international conference to establish a new financial system? Espersen: I welcome international conferences. I think that it’s important that we get some are international solutions. So I think that’s the right way to go. I think we should run different tracks – both what we can do here, but also internationally. This is not only a Danish problem. It’s a problem in the entire world. SI: Will you contact Sarkozy regarding that Denmark should join in to create such a New Bretton Woods financial system? Espersen: I do not plan to contact Sarkozy, but I know that the [Danish] Prime Minister will meet Sarkozy shortly, because there is an EU summit meeting, and I know that he will have the opportunity to discuss this. |

Overheads for the speech

|