Watch Lyndon LaRouche's international internet webcast

Wednesday, October 1, kl. 19:00 (Danish Time)

See the 7-minute trailer for the webcast "Now, more than ever: The Big Four" at: http://larouchepac.com/news/2008/09/16/now-more-ever-big-four.html

|

Schiller Institute Chairman Tom Gillesberg interviewed on Danish Radio's nationwide P3 station about the financial crisis |

|

COPENHAGEN, Sept. 29 -- Danish Schiller Institute Chairman Tom

Gillesberg was interviewed for 6 minutes during drive-time, on Danish

Radio program 3 about how he knew there was going to be a financial

crash, as evidenced by his 2007 election poster "After the Financial

Crash -- Maglev across the Kattegat" (the strait between the island upon

which Copenhagen is located with the Jutland mainland). Gillesberg

pointed to Lyndon LaRouche, his July 2007 webcast, and his upcoming Oct.

1 webcast this Wednesday. A translation of the live interview follows:

TG: Hi. HOST: The first question is clearly, we need to know, how were you able to predict that there would be a financial crisis, when we others just knew nothing about it? TG: I was able to, because I listened to the American economist and statesman Lyndon LaRouche, who actually already at the end of July last year, said, "It's going to happen now. It is happening now. The financial system is going to disappear now. It's going to happen piece by piece, and we have to discuss what to do." HOST: So that's where you got your information? TG: You can say that. It should be said that I have worked with this for a while, with the Schiller Institute, and back in November 2005, during the municipal elections in Copenhagen, I had a big election campaign with the slogan, "When the Bubble Bursts -- a New Bretton Woods." That the housing bubble, which has been the driving force in the Danish economy, especially in 2005, I said, "This is a bubble, which will disappear. It's going to hurt in Denmark when it happens, but this is just a Danish part of a global financial bubble." HOST: We remember your campaign. We remember your poster, "After the Financial Crash: Maglev across the Kattegat." How does maglev fit into your philosophy? TG: Because, when a financial system collapses, and that's what we see, first, you have to have a new financial system -- a New Bretton Woods--and actually, the French President today summoned such a conference to discuss what we should do now. So, we have to have a new system. But there is a tendency when all the financial values go up in smoke, that there isn't any money in a country like Denmark. No one will invest in anything. Therefore, the state has to -- unless everything is to go black, and the whole economy die -- the state must go in with big infrastructure projects to get things going. That's, of course, highways, schools, hospitals, but, more than anything, new, modern technology, and maglev, which runs at 500 kph, is what we need for the future in Denmark. HOST: That's a fine idea, but is it still a good idea, now that the crisis is happening? TG: Yes, because if we are to get out of this financial crisis, it won't be by pumping money into the banks. It won't be by having a Roskilde Bank in oversize, and using all of the taxpayers' money for that. It will be by reorganizing the financial system. It will be by having a bankruptcy reorganization of the banks and the system. And we should ensure putting money into infrastructure projects and economic development. And if we do that, instead of the Danish economy -- when people can no longer borrow money, then they don't go into the special shops, they don't build new terraces. Everything that has driven the economy, that stops. Then you get unemployment. Then you get an eerie downside, unless you go in with infrastructure projects. And maglev is one of a panoply -- there is also a Kattegat Bridge, also highways. There is an unbelievable amount of infrastructure that we are lacking. If you do that, you get the economy going. HOST: And that's a good idea, I can hear. You were right about the financial crisis. I would like to end by asking you what other areas should we keep an eye on in the future? TG: This financial crisis we have been seeing so far is just the beginning. It will be much, much worse. This is just the first wave we are having. It can be really eerie. This can be a bigger financial crisis than in the 30's. We have to go all the way back to the 1300's to find something that is like it, when the financial system collapsed, and, as most know, when we had the Black Death, and many bad things all over Europe. It's not just the housing bubble, not just the stock market bubble, not just the credit card bubble, it is the whole system which is in the process of disappearing. What you should do is to go to the internet, to www.boblenbrister.dk ("thebubblebursts") Then, you get to the Schiller Institute's website, and there is a lot written about these things. And on Wednesday, Oct. 1, you can actually hear our man Lyndon LaRouche, live from Washington, say what we should do. And you will get the answer to what is coming, what we should do, and you will get a suggestion from the man who has able to very precisely predict all of this, and who is a little ahead of me in all of this. HOST: It sounds like it was not something good we have been waiting for. But that we can agree that we have to cross our fingers for the future, and thank you. TG: And as long as we are able to change axioms and understand that what has been "good Latin" in economics has to be thrown out the window, and we have to find other things, where the physical economy counts, the real economy -- industry, farming, production, etc. then, we can certainly come out of this. It requires that we really pressure the politicians, because they have a tendency to do what others are doing.

HOST: Tom Gillesberg. Thank you.

Further information: www.schillerinstitut.dk www.larouchepub.com 2007 Danish parliamentary election poster: After the financial crash: Magnetic levitation (maglev) across the Kattegat

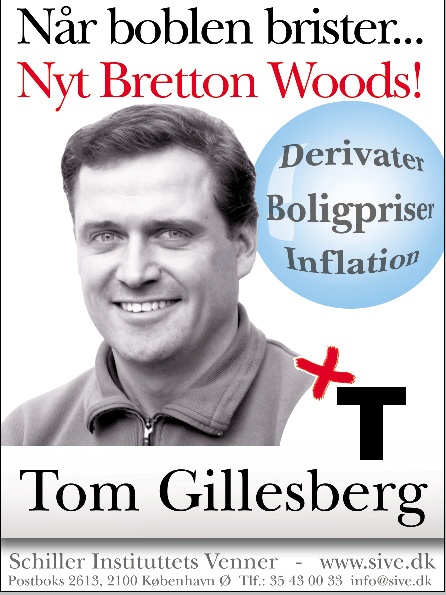

2005 Danish municipal election poster: When the bubble bursts ... New Bretton Woods (financial system):

|